Arch Model Example . a complete arch model is divided into three components: a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. A mean model, e.g., a constant mean or an arx; a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. arch models were created in the context of econometric and finance problems having to do with the amount that investments or stocks. the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time.

from www.myxxgirl.com

It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. A mean model, e.g., a constant mean or an arx; arch models were created in the context of econometric and finance problems having to do with the amount that investments or stocks. • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. a complete arch model is divided into three components: a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations.

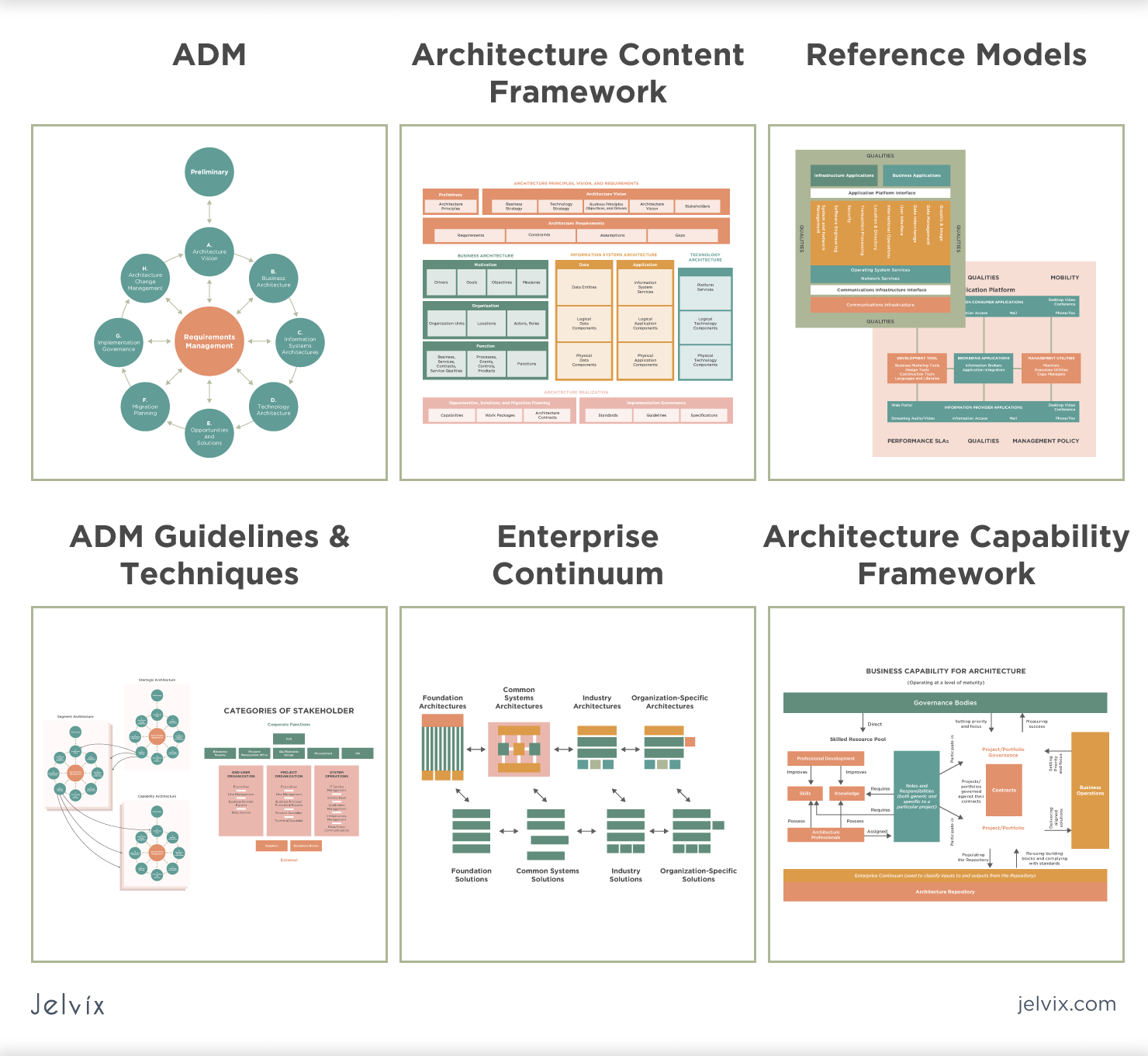

Togaf Business Architecture Conceptualarchitecturalmodels Pinned By

Arch Model Example autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. A mean model, e.g., a constant mean or an arx; a complete arch model is divided into three components: the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. arch models were created in the context of econometric and finance problems having to do with the amount that investments or stocks.

From www.researchgate.net

An example ArchiMate model Download Scientific Diagram Arch Model Example It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. A mean model, e.g., a constant mean or an arx; a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. arch models were created in the context of. Arch Model Example.

From www.infoq.com

The C4 Model for Software Architecture Arch Model Example a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. arch models were created in the context of econometric and finance problems having to do with the amount that investments or stocks. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. a. Arch Model Example.

From sketchfab.com

Semi Circular Brick Arch Download Free 3D model by mbhplc [8850d25 Arch Model Example the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. A mean model, e.g., a constant mean or an arx; a clear example of this is provided by the daily returns for general motors. Arch Model Example.

From www.slideserve.com

PPT GARCH Models and Asymmetric GARCH models PowerPoint Presentation Arch Model Example a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. a complete arch model is divided into three components: a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. It is given by σ2 t = ω + αr2 t 1 + βσ 2. Arch Model Example.

From www.youtube.com

Tutorial Modeling an Arch Part 1 YouTube Arch Model Example autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. A mean model, e.g., a constant mean or an arx; a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the. Arch Model Example.

From www.youtube.com

ARCH and GARCH Models YouTube ARCH vs GARCH YouTube Arch Model Example A mean model, e.g., a constant mean or an arx; autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. a clear example. Arch Model Example.

From tovatiz.blogspot.com

Architecture Diagram Software Example Arch Model Example a complete arch model is divided into three components: arch models were created in the context of econometric and finance problems having to do with the amount that investments or stocks. A mean model, e.g., a constant mean or an arx; a clear example of this is provided by the daily returns for general motors from sept. Arch Model Example.

From www.re-thinkingthefuture.com

10 Types of Architecture Models and how to make them RTF Arch Model Example • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. A mean model, e.g., a constant mean or an. Arch Model Example.

From en.ppt-online.org

ARCH and GARCH. Modeling Volatility Dynamics online presentation Arch Model Example a complete arch model is divided into three components: a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. A mean model, e.g., a constant mean or an arx; autoregressive conditional heteroskedasticity. Arch Model Example.

From in.pinterest.com

Suspended Arch Water Road Bridge Bridge design, Bridges architecture Arch Model Example a complete arch model is divided into three components: a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. • the generalized arch or garch model is a parsimonious alternative to an arch(p). Arch Model Example.

From www.turbosquid.com

3d model of arch bridge Arch Model Example It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. • the generalized arch or garch model is a. Arch Model Example.

From www.myxxgirl.com

Togaf Business Architecture Conceptualarchitecturalmodels Pinned By Arch Model Example autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. It is given by σ2 t = ω + αr2 t. Arch Model Example.

From manuallistsmugglers.z21.web.core.windows.net

Architecture Diagram Examples Arch Model Example a complete arch model is divided into three components: autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. the arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized. arch models were created in the context of econometric and finance problems having to do with the amount that investments. Arch Model Example.

From www.infoq.com

The C4 Model for Software Architecture Arch Model Example • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. a complete arch model is divided into three components: It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where. Arch Model Example.

From www.erp-information.com

Enterprise Architecture Framework (Types, Methods, and Benefits) Arch Model Example • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. arch models were created in the context of. Arch Model Example.

From www.archimatetool.com

C4 Model, Architecture Viewpoint and Archi 4.7 Archi Arch Model Example a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. autoregressive conditional heteroskedasticity (arch) is a statistical model used to analyze volatility in time. • the generalized arch or garch model is a parsimonious alternative to an arch(p) model. a clear example of this is provided by the daily returns for general. Arch Model Example.

From www.youtube.com

SE 25 Architectural Design Model Complete Explanation with Examples Arch Model Example It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch. a complete arch model is divided into three components: a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. A mean model, e.g., a constant mean or an. Arch Model Example.

From www.hosiaisluoma.fi

Simplified ArchiMate Metamodel Holistic Enterprise Development Arch Model Example a clear example of this is provided by the daily returns for general motors from sept 1’st to nov. a garch (generalized autoregressive conditionally heteroscedastic) model uses values of the past squared observations. a complete arch model is divided into three components: arch models were created in the context of econometric and finance problems having to. Arch Model Example.